While many people may think that checks are outdated and unnecessary, there are actually a lot of benefits to using them. Here are a few of them:

One of the key advantages to using business checks is security. Checks are tied to the person they’re written for and can only be cashed by that individual. This makes it much more difficult for someone to cash a check they didn’t mean to and steal money.

1. Security

Aside from the security of having your name and address on every check, business checks also offer a number of other benefits. The most obvious is that they increase brand recognition, as customers are much more likely to purchase a recognizable brand versus an unfamiliar one.

Adding your logo to the front of your checks is an effective way to reinforce that message and enhance brand awareness. Additionally, they help to improve brand loyalty and promote customer retention.

Business checks are a popular payment option among small businesses. Even though debit and credit cards have become the norm for many transactions, checks continue to be used by a growing number of companies.

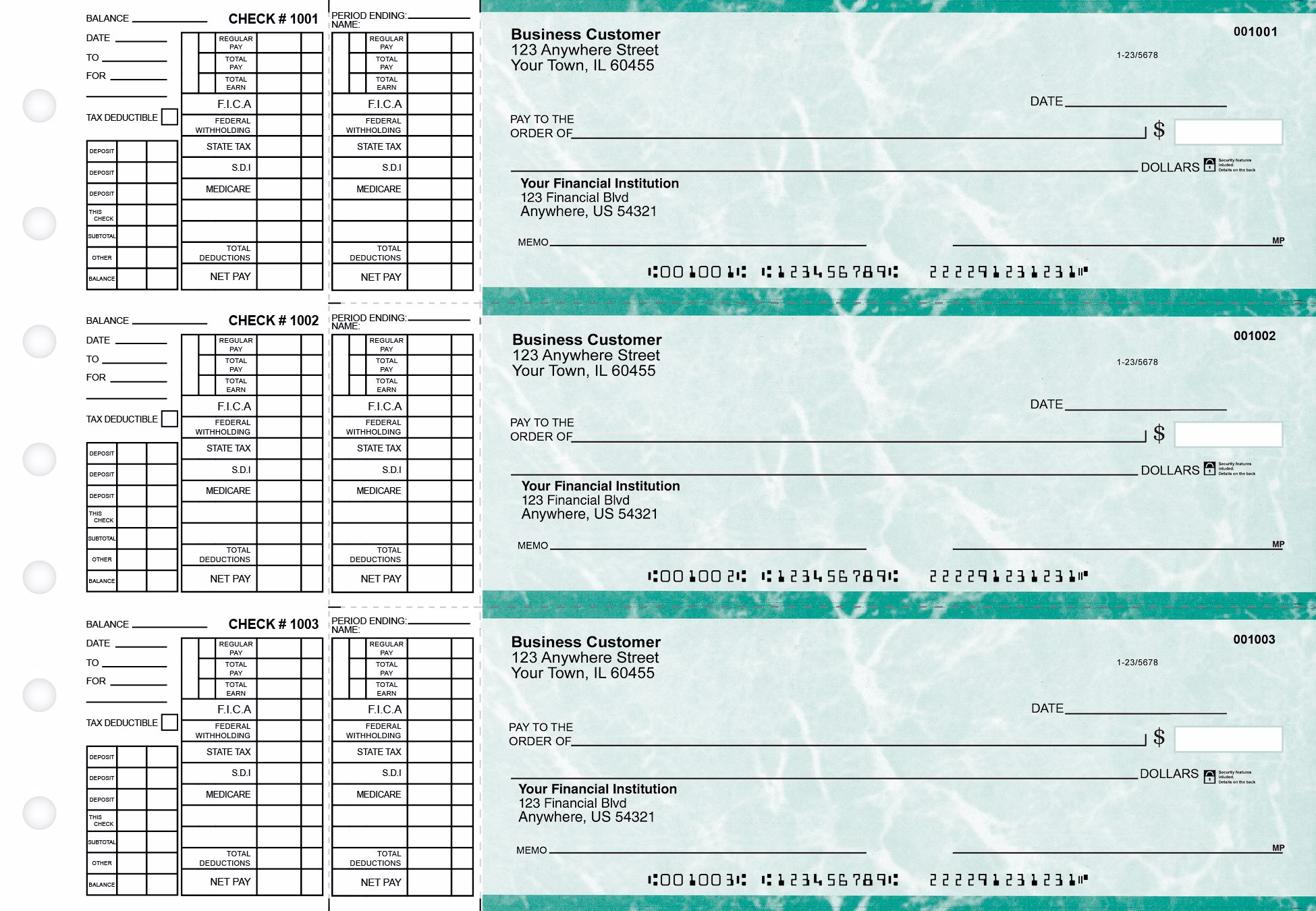

With the increasing prevalence of fraud, it’s important to make sure you’re using the most secure checks possible. High Security checks offer a number of dependable features, including a watermark, hologram image and heat-sensitive ink, which makes them difficult to reproduce. They’re also compatible with money management software (think Microsoft money and Quickbooks) for added security.

2. Convenience

Business checks are a great way to ensure your transactions are recorded. They are also useful for keeping track of expenses when filing taxes.

They are typically larger than personal checks, so there is room to write in the company logo and to include a memo line, which allows you to record the details of your transaction. They also usually come with a payee line to accommodate your payee’s address, if needed.

In addition, business checks are usually printed on thicker paper than personal checks, so they have more security features. These may include holograms, fluorescent fibers and watermarks.

Another convenience benefit of using business checks is that they do not require you to carry cash. This can save you time and money by allowing you to make multiple payments at once, and it also makes the process easier for customers who may not be comfortable carrying cash.

3. Ease of Use

Business checks are an economical way to keep track of expense accounts. They are also less expensive than providing all employees with personal credit cards.

Unlike company credit cards, which can charge interest on unpaid balances and can be difficult to use due to annual fees, business checks are free to issue.

Some companies even provide their employees with business checks that they can write out to local businesses in lieu of a personal check or company-owned credit card. This is a convenient option for both the company and its employees.

Another advantage of using business checks is that they are backed by a business account. This helps to avoid the possibility of the check getting overdrawn and causing problems for the business.

The convenience of using checks is a key reason why many businesses still choose to write them out. In fact, up to 97% of small businesses accept paper checks.

4. Customization

Business checks are a professional form of payment that provide a paper trail for tax purposes. They also provide a more secure payment method than credit cards, which can be targeted by thieves.

Businesses can customize their checks to include a business logo, company colors, and baking details. This helps them establish a brand image and build trust with their customers and business associates.

Customized business checks don’t have processing charges, offer consistency, and make them look professional. They are also a great way to increase the value of your company.

Business checks are available in a variety of styles, including wallet-sized checks that closely resemble personal checks. They also come with several security features, such as watermarks, thermochromic ink, bleed-through numbering, and holograms. They can be purchased online or at a bank.