Blockchain in Banking: What You Need To Know?

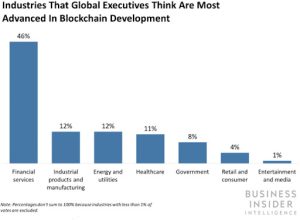

Blockchain’s early adoption is widely claimed to be in the financial sector due to its numerous advantages over traditional methods. Now, it has taken a big step in the banking industry. There is the widespread use of blockchain technology in banking.

As per a recent survey, it’s found that blockchain applications in the financial sector will grow further in the coming years, reaching a market size of around 22.5 billion U.S. dollars in 2026. Indeed, it is one of the most promising and hyped technologies in recent years.

Blockchain promises to revolutionize the banking sector by providing a secure, efficient, and transparent way of conducting transactions. But what exactly is blockchain? How does it work? And what implications does it have for banks and other financial institutions?

In this article, we’ll answer all these questions and more so that you can make an informed decision about whether blockchain is something your bank should be investing in.

So, let’s get started.

What is Blockchain?

Blockchain is a decentralized advanced digital ledger that records all transactions made in a network in a secure and tamper-proof way. All the parties involved verify every transaction and record it as a block on the chain. Once you add a block to the chain, you can’t make any changes or delete anything.

It makes blockchain an immutable record of all transactions made in the network, which can track ownership, prevent fraud, and enable transparency.

How does Blockchain work?

The key to understanding how blockchain works understand the concept of a distributed ledger. A distributed ledger is a database spread across a network of computers, each containing a ledger’s copy.

Blockchain is a digital ledger that is used to record transactions. Each transaction is recorded as a block, and each block is chained together with the previous block, creating a blockchain. This allows for secure and transparent recording of transactions.

When anyone makes a transaction, it is verified by all the computers in the network and then added to the Blockchain as a block. The verifiers are known as “miners,” They are rewarded for their work with cryptocurrency.

After adding a block to the Blockchain, it cannot be changed or removed. It makes the Blockchain an immutable record of all transactions made in the network.

How does Blockchain benefit banks?

Banking is a sector that is ripe for disruption. The centralized nature of the banking system makes it slow, inefficient, and vulnerable to attack. Blockchain offers a way to make banking faster, more efficient, and more secure.

Some of the ways that blockchain can benefit banks include:

Cost Reduction

Banks today still rely on centralized infrastructure that is costly to maintain and slow. Various banking activities such as clearing and settlement need to go through a central authority which can take days.

The decentralized technology of blockchain can do away with the need for a central authority and enable near-instant clearing and settlement. It would lead to a significant reduction in costs for banks.

Increased Security

Banks are constantly under threat of attack from external hackers and internal fraudsters. The centralized nature of the banking system makes it an easy target for attackers.

The decentralized nature of blockchain means that there is no central point of attack for hackers. It gives no room for any fraudulent activities.

Also, each transaction gets verified by all the parties involved before it is recorded on the blockchain. So, you should hire Blockchain developers in India to add an extra security layer.

Improved Transparency

Today’s banking system is opaque, with little visibility into how banks operate or where the money goes. Such a lack of transparency has led to a loss of trust in banks.

Blockchain can help increase transparency in the banking system by providing a public record of all transactions. It would allow people to see where their money is going and how it is used.

Instant Payments & Money Transfers

One of the most significant pain points for banks’ customers is the slow speed of payments. It can often take days for an amount to go through, which is frustrating for customers.

Blockchain can help speed up payments and money transfers by eliminating the need for intermediaries. It would lead to near-instant payments that are convenient for customers.

Digital Currency

Banks are already exploring the use of digital currencies such as Bitcoin and Ethereum. Digital currencies have the potential to revolutionize how we bank and make payments.

Blockchain is the technology that powers digital currencies. It can also help banks to become more efficient and reduce costs. Banks can stay ahead by investing in blockchain and being at the forefront of this digital market.

Reduced Error Rates

The current banking system is rife with errors. A recent study found that 78% of banks have experienced increased error rates over the past three years.

Blockchain can help reduce errors by providing a single source of truth for all transactions. It would lead to fewer mistakes and a more efficient banking system. Even a slight reduction in error rates can lead to enormous savings for banks.

Improved Customer Experience

Banks today are struggling to meet the demands of their customers. They are often seen as slow, inflexible, and difficult to deal with sometimes.

The digital nature of blockchain means that it can create a more seamless and user-friendly customer experience. It would lead to happier customers and more repeat business.

How can Blockchain technology be used in banks?

1. Accounting & Audit

Blockchain’s usage in accounting and auditing could help to improve the accuracy of financial statements and make it simple for auditors to verify the data. It would lead to more reliable financial reporting and improved investor confidence.

For example- In 2016, a group of banks in Japan began testing a blockchain-based system for auditing. The system tracks and verifies transactions in real-time, making it easier for auditors to do their job.

2. Anti-Money Laundering (AML) & Know Your Customer (KYC)

KYC and AML are two of the most critical compliance requirements for banks. The use of blockchain could help to improve both of these areas. Many experts believe blockchain is the key to solving the AML/KYC challenges.

For example- In 2017, a group of banks in Australia launched a blockchain-based system for KYC compliance. The system enables banks to share customer data securely and efficiently. It reduces the cost and time required to comply with KYC regulations.

3. Trade Finance

Among other things, blockchain can help to reduce the time and costs associated with trade finance. The technology can create a digital record of contracts, invoices, and other documents. This would make it easier for banks to verify the data and speed up the process.

For example- In 2017, a group of banks in Singapore launched a blockchain-based platform for trade finance. The platform speed up the financing of international trade transactions. It would reduce the cost and time required to finance trade deals.

4. Cross-Border Payments

Transferring money between different countries is a slow and expensive process. Blockchain can help to speed up cross-border payments and make them more efficient. Even a slight improvement in efficiency can lead to big savings for banks.

For example- Europe-based Ripple is working with many banks to develop a blockchain-based system for cross-border payments. The system is faster and more efficient than the current SWIFT system.

5. Loans & Mortgages

Providing loans and mortgages is a complex process that involves many different parties. Many times, the process is slow and cumbersome. The use of blockchain could help to streamline the process and make it more efficient. It would also lead to improved transparency and reduced costs.

For example- India-based startup, Kyezz is working on a blockchain-based platform for loans and mortgages. The platform provides a more efficient and transparent process. It would also help to reduce the costs associated with these products.

6. Insurance

The insurance industry is another area where Blockchain can improve efficiency. There are many different processes involved in insurance, from policy creation to claims processing.

With Blockchain, the insurance industry can move towards a more digital and automated business. It would lead to reduced costs and improved customer service.

For example- AIG, one of the world’s largest insurance companies, is testing a blockchain-based system for processing claims. The system is more efficient than the current manual process. It would also help to reduce fraud and improve customer service.

7. Asset Management

Banks have trillions of dollars worth of assets under management. The use of Blockchain can help to improve the efficiency of asset management. It would also lead to improved transparency and reduced costs.

8. Regulatory Compliance

Banks are subject to a variety of regulations. The use of Blockchain can help to improve compliance with these regulations. It would bring more transparency and cost reduction.

9. Crowdfunding

Crowdfunding is a popular way of raising money for startups and small businesses. However, the current banking system makes it difficult to get funding from banks. The use of Blockchain can help to streamline the process and make it more efficient.

What are the top challenges of Blockchain implementation in the banking sector?

1. Regulations and Governance:

Governance is one of the most important aspects of any industry, and the banking sector is no different. The rules and regulations vary from country to country, and it can be difficult to keep up with the changing landscape.

Let’ see how governance becomes a roadblock in different countries:

-The European Union rigidly believes in data privacy. The GDPR, effective from May 2018, bind companies to protect user data and gives individuals the right to information about how their data is being used. It creates a challenge for blockchain startups since they need access to large amounts of data to build their products.

– China has banned ICOs and exchanges. This makes it a challenge for blockchain startups since they need access to capital to develop their products. The country is also cracking down on cryptocurrency mining.

– USA’s SEC is taking a cautious approach to regulating the ICO market. The government is also cracking down on cryptocurrency exchanges. It creates a challenge for blockchain startups since they need access to capital to build their products.

2. Interoperability:

The banking sector is a complex ecosystem with a variety of stakeholders. For blockchain to be successful in the banking sector, it needs to be able to interact with legacy systems.

There are a few challenges in this area:

-Different blockchains have different standards. This makes it challenging to create a single solution that can work across all platforms.

-The banking sector is highly regulated. It is challenging to build a blockchain solution that meets all the compliance requirements.

3. Scalability

Scalability is one of the critical challenges in blockchain technology. The ability to process large amounts of data is essential for the success of blockchain in the banking sector.

At present, the Bitcoin blockchain can only process 7 transactions per second. In comparison, Visa can process 24,000 transactions per second. This scalability problem needs to be addressed for blockchain to succeed in the banking sector.

4. Security:

Security is a significant area of concern in the banking sector. The use of blockchain technology in the banking sector would require the same level of security as the traditional banking system.

Currently, there are a few challenges in this area:

-Theft: Cryptocurrencies worth millions of dollars have been stolen from exchanges. It creates a risk for banks using blockchain to store their assets.

-Hacking: The decentralized nature of blockchain makes it difficult to protect against hacking. It is a primary concern for banks who want to use blockchain to store their assets.

-51% Attack: A 51% attack is when a group of miners controls more than 50% of the network power. It gives them the ability to double-spend coins, and it is a primary concern for banks who want to use blockchain to store their assets.

Read Also: 10 Most Amazing Hybrid App Development Frameworks for 2022

Conclusion

With the incredible benefits of blockchain technology, it is expected that the banking sector will begin to adopt this technology soon. However, a few challenges need to be addressed before this can happen.

These challenges include regulations and governance, interoperability, scalability, and security. The proper planning and expert guidance can overcome these challenges and help blockchain technology realize its potential in the banking sector.

So, if you are a bank or financial institution looking to adopt blockchain technology, get in touch with a Blockchain app development company in India. They are experts in the field and can help you overcome the current challenges.